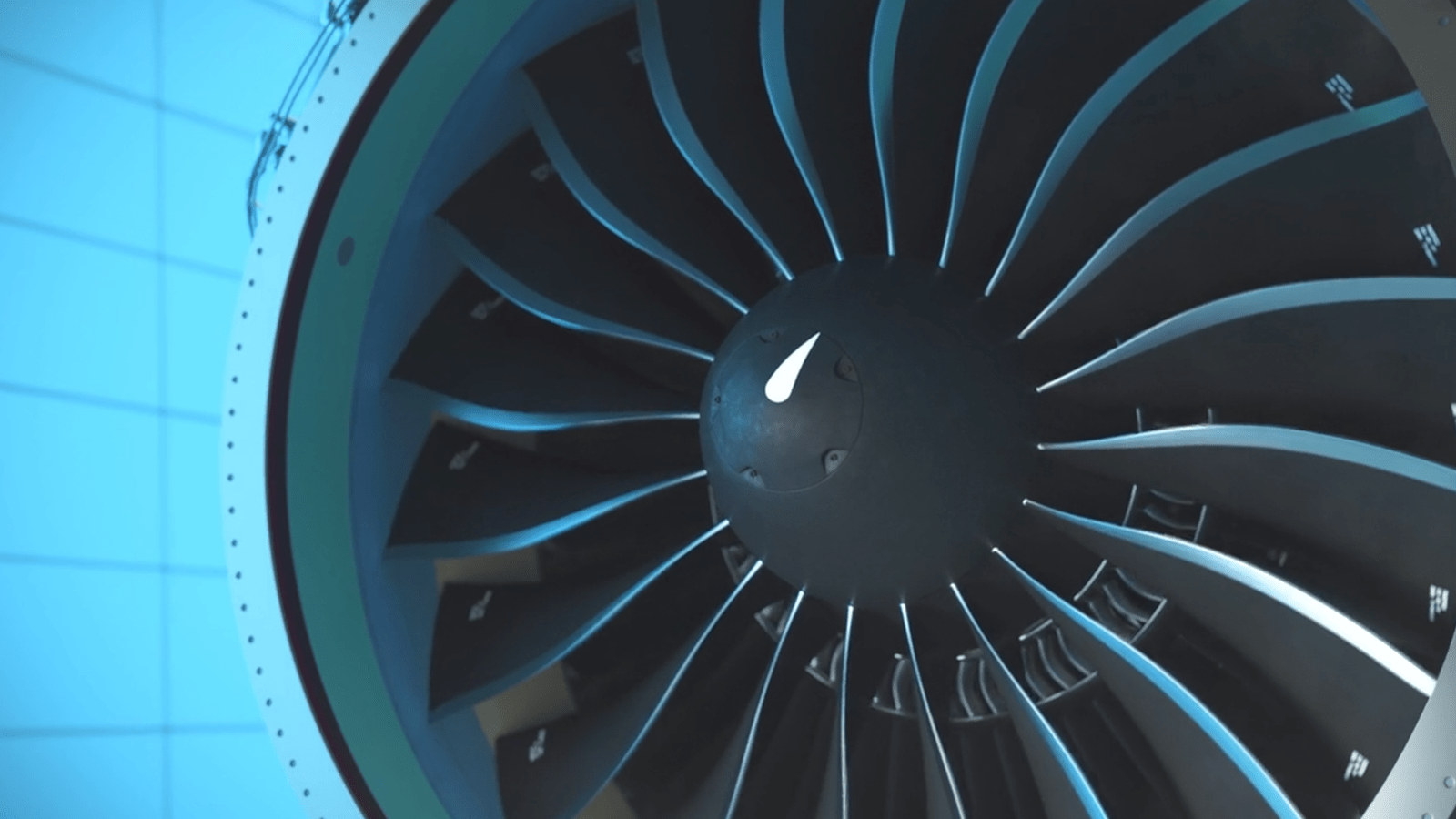

IBA, aviation market intelligence and consultancy company, has predicted that engine market values and lease rates are likely to increase given the current and ongoing supply chain issues and the more specific GTF engine problem.

The company expects the industry to suffer longer term due to growing pressure on shop visits and turnaround times, which are forecasted to increase.

MRO shop visits are already under pressure from the post-Covid resource gap and the unscheduled GTF engine inspections, the IBA team, comprising President Phil Seymour, Engine and Parts Manager Jamie Davey, and Sarah Farrugia-Warren Senior Technical Manager – Powerplant, said. Previous generation engines are still undergoing shop visits following deferred maintenance because of the global pandemic, resulting in high parts demand.

In the shorter term, turnaround times are likely to be strained further as Pratt & Whitney GTF engine issues increase pressure. The number of engines due to be inspected will cause a short-term spike in shop visit demand and the impact will be far-reaching, especially if the mandated inspections of the high pressure turbine (HPT) create additional work once engines are opened up.

Some of the operators most affected by the GTF issues include Go First with 88 engines, IndiGo with 80 engines, and Air China with 36. Other affected airlines include large A320 operators such as Wizz Air.

“We have to remember that the engine OEMs are at the leading edge of design and material technology. The incredible advances in fuel burn saving over the decades has led, and will likely continue to lead, to some form of Airworthiness Directives action. It’s the price we pay for driving towards more efficient aircraft and engine combinations, with the overriding need for safe operations. We will have to see if the fuel burn benefits also create a long-term improvement in on-wing times and overall lower cost per hour/cycle,” said Phil Seymour, IBA’s President.

IBA predicts that, in 2024, there will be around 2,500 shop visits (excluding the GTF additional shop visits) followed by a significant jump to 3,500 visits in 2025. There were 2,250 visits in 2023. This situation should come to a slight plateau between 2025 and 2027 at around 3,800 visits annually before peaking to over 4,000 visits in 2028. This will then start to decrease, ending the decade just below 4,000 visits in 2030.

According to the company, here will be new engine production delays and USM supply chain demand will continue to affect values and lease rates.

General Atomics Aeronautical Systems, Inc. (GA-ASI) is partnering with Shift5 to integrate the company’s onboard cyber anomaly detection and predictive…

The Malaysian Ministry of Defence (Mindef) has finalised 40 agreements totalling RM7.3 billion, encompassing seven contracts valued at RM1.90 billion,…

Leonardo, an Italian aerospace company, and the Ministry of Defense of Malaysia (Mindef) have marked a significant milestone during the…

Turkish land systems manufacturer Otokar is displaying its Cobra II and Akrep II armoured vehicles at DSA. The Cobra II…

Systems Engineering & Assessment (SEA), a technology company based in the UK, proudly displays its advanced decoy launcher Ancilia, at…

The Czech Republic’s Excalibur Army has its debuts in the ongoing show. The company is bringing a few small scale…

Turkiye’s Secretariat of Defence Industries (Savunma Sanayii Başkanlığı-SSB), has two main objectives: modernization of Turkish Armed Forces, and establishing&developing a…

Malaysian company, Smart Weapon Storage Inntech Sdn Bhd (SWS), which has been around for 20 years, aims to extend its…

“We will continue to provide tailored solutions to our customers,” said Cem Altinisik, FNSS Corporate Communication Manager in an interview…

Tony Chegwidden, the Director of Business Development International at EDGE Group, is sharing his thoughts regarding the group’s focus and…

Boeing has advanced its manned-unmanned teaming (MUM-T) technology using a digital F/A-18 Super Hornet and MQ-25 Stingray. The testing shows…

Malaysia’s Lumut Naval Shipyard Sdn Bhd (LUNAS) inked a Memorandum of Understanding (MoU) with Indonesian shipbuilder PT PAL Indonesia at…

Prime Minister of Malaysia, Datuk Seri Anwar Ibrahim, attended the unveiling of MALVUS SENSE SDN BHD’s CW-25H, a significant development…

KNDS France which is the main provider of artillery systems for the Royal Malaysian Army and a strategic industrial partner…

The upcoming 10th edition of Indo Defence 2024 Expo & Forum, renowned as one of the foremost international defence industry…

Malaysian firm MILDEF International Technologies unveiled its new Tarantula, 4x4 High Mobility Armoured Vehicle (HMAV) at the ongoing DSA. Also…

Nurol Makina and Nadicorp (Badanbas) are showing their NMS 4X4 armoured vehicle in Royal Malaysian Army camouflage for the first…

South African defence firm Denel is presenting its portfolio of guided weapons and land defence systems at the show. “Denel…

The Malaysian armed forces are accelerating their procurements of modern military equipment in their quest to transform their combat capability.…

PT Dirgantara Indonesia (PTDI) is currently participating in the Defense Services Asia (DSA) 2024 defence exhibition, scheduled from 6th to…

The French defence company and a leader in ground mobility solutions, Arquus is showcasing its proven range of defence and…

Tell me about Cendana Auto, and the products that you're featuring here? Cendana Auto is 100% a local Malaysian company,…

Thailand’s defence land system company, Chaiseri, is bringing three of its First Win (FW) series armoured vehicles to the show.…

Turkish weapons company Roketsan is showcasing its broad range of missile equipment at the ongoing show including its new generation…

Malaysia will buy 10 AN/AAQ-33 Sniper Advanced Targeting Pods from the United States. The proposed sale will improve Malaysia’s capability…

As far as high-profile visits go, this one was right up there on the list. After speaking at the opening…

Malaysia’s Weststar Defence Industries has partnered with International Armored Group (IAG) to display the IAG Guardian Armoured Personnel Carrier (APC)…

Singapore Minister for Defence Dr Ng Eng Hen’s presence at the ongoing show and his meeting with Malaysia's Prime Minister…

Emirates will add another 43 A380s and 28 Boeing 777 aircraft to its extensive cabin retrofit programme lifting the total…

Lilium, developer of the first all-electric vertical take-off and landing (eVTOL) jet is partnering with advanced air mobility (AAM) operator…

Headquartered in Singapore with reporters spread across all major regions, GBP Aerospace & Defence is a leading media house that publishes three publications that serve the aerospace and defence sector - Asian Defence Technology, Asian Airlines & Aerospace and Daily News. Known industry-wide for quality journalism, GBP Aerospace & Defence is present at more international tradeshows and exhibitions than any other competing publication in the region.

For over three decades, our award-winning team of reporters has been producing top-notch content to help readers stay abreast of the latest developements in the field of commercial aviation, MRO, defence, and Space.

Copyright 2024. GBP. All Rights Reserved.

Home Defence & Security Space Commercial Aviation Maintence Repair & Overhaul Daily News Events About Us

2024 GBP all rights reserved.